Understanding NMFB: A Comprehensive Guide To Nigeria's National Microfinance Bank

In recent years, the National Microfinance Bank (NMFB) has emerged as a critical financial institution in Nigeria, aimed at fostering economic growth and financial inclusion. Established to address the financial needs of underserved populations, NMFB plays a pivotal role in providing accessible financial services to micro, small, and medium enterprises (MSMEs) across the country. This article delves into the various aspects of NMFB, its significance, operations, and the impact it has on the Nigerian economy.

With the increasing focus on financial inclusion, NMFB has positioned itself as a key player in empowering individuals and small businesses who often lack access to traditional banking services. By providing microloans, savings accounts, and other financial products, NMFB aims to uplift communities and promote sustainable economic activities. This comprehensive guide will cover everything you need to know about NMFB, from its inception to its current operations and future prospects.

Whether you are an entrepreneur seeking financial support or simply interested in understanding Nigeria's financial landscape, this article will provide valuable insights into NMFB and its contributions to the economy. Let's explore the world of NMFB and discover how it is transforming lives and businesses across Nigeria.

Table of Contents

- Biography of NMFB

- Mission and Vision of NMFB

- Services Offered by NMFB

- Impact of NMFB on the Nigerian Economy

- Challenges Faced by NMFB

- Future Prospects of NMFB

- Conclusion

- Trusted Sources

Biography of NMFB

The National Microfinance Bank (NMFB) was established in 2020 as part of the Nigerian government's efforts to enhance financial inclusion and access to credit for small businesses and individuals. With a focus on providing tailored financial solutions, NMFB aims to bridge the gap between formal financial institutions and underserved communities.

Key Data and Personal Information

| Data | Details |

|---|---|

| Name | National Microfinance Bank |

| Established | 2020 |

| Headquarters | Abuja, Nigeria |

| Type | Microfinance Bank |

| Website | nmfb.com.ng |

Mission and Vision of NMFB

NMFB's mission is to promote financial inclusion by providing microfinance services that empower individuals and small businesses to achieve their economic potential. The vision of NMFB is to be a leading microfinance institution that provides innovative financial solutions tailored to the needs of underserved populations.

Services Offered by NMFB

NMFB offers a range of financial products designed to meet the diverse needs of its clients. These services include:

- Microloans

- Savings Accounts

- Insurance Products

- Financial Literacy Programs

Microloans

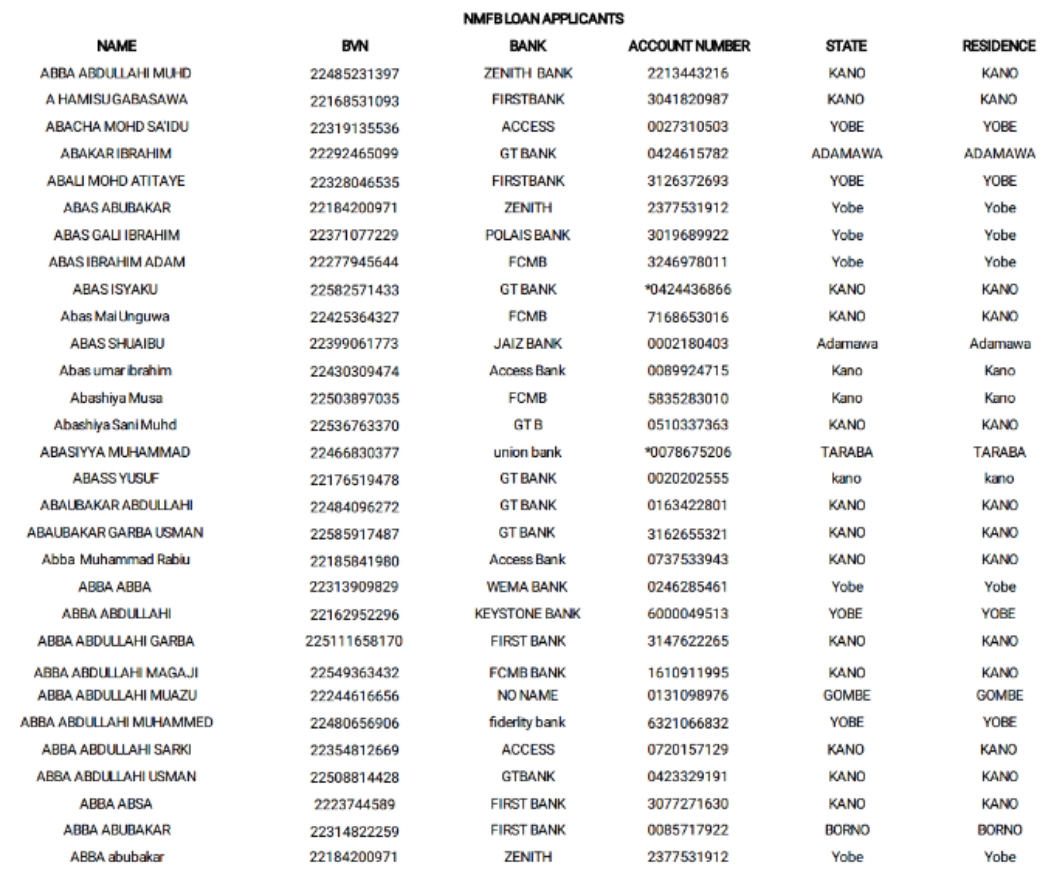

One of the primary services offered by NMFB is microloans, which provide small amounts of credit to individuals and businesses. These loans are designed to help clients start or expand their businesses, improve their living conditions, and increase their income levels.

Savings Accounts

NMFB also offers savings accounts that encourage clients to save money and build financial resilience. By providing attractive interest rates and easy access to funds, NMFB promotes a culture of saving among its clients.

Impact of NMFB on the Nigerian Economy

The establishment of NMFB has had a significant impact on the Nigerian economy. By providing financial services to underserved populations, NMFB has contributed to poverty alleviation and economic empowerment.

Supporting MSMEs

Micro, small, and medium enterprises (MSMEs) are vital to Nigeria's economic growth. NMFB's focus on supporting MSMEs through microloans has helped thousands of entrepreneurs start and grow their businesses, creating jobs and stimulating economic development.

Promoting Financial Inclusion

NMFB's initiatives have also played a crucial role in promoting financial inclusion in Nigeria. By reaching out to underserved communities and providing accessible financial services, NMFB has empowered individuals to participate in the formal economy.

Challenges Faced by NMFB

Despite its successes, NMFB faces several challenges that hinder its operations. Some of these challenges include:

- Limited Awareness: Many potential clients are unaware of the services offered by NMFB.

- Regulatory Hurdles: Navigating regulatory requirements can be a complex process for NMFB.

- Funding Constraints: Access to sufficient funding is essential for NMFB to meet the growing demand for its services.

Future Prospects of NMFB

Looking ahead, NMFB is poised for growth and expansion. With the increasing demand for financial services among underserved populations, NMFB aims to enhance its product offerings and reach more clients across Nigeria. Investments in technology and partnerships with other financial institutions will also play a crucial role in NMFB's future success.

Conclusion

In conclusion, the National Microfinance Bank (NMFB) plays a vital role in promoting financial inclusion and supporting economic growth in Nigeria. By providing accessible financial services to underserved populations, NMFB has made significant contributions to poverty alleviation and the empowerment of individuals and businesses. As NMFB continues to evolve and expand its services, it is essential for stakeholders to support its initiatives and help create a more inclusive financial landscape in Nigeria.

We encourage readers to share their thoughts in the comments, explore more articles on our site, and stay informed about the ongoing developments in Nigeria's financial sector.

Trusted Sources

For more information on NMFB and its impact, please refer to the following sources:

Glen Crain: The Journey Of A Rising Star In The Music Industry

Shyheim Jenkins: The Rise And Legacy Of A Hip-Hop Icon

C.A.T Anime: Exploring The Fascinating World Of Cat-Centric Anime